50

+

Years

of Experience

110

+

Outlets

Across Nigeria

6

+

Strategic

Zonal Offices

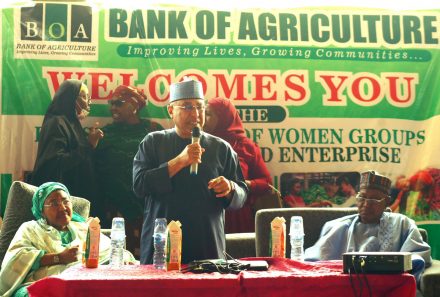

OUR MANDATE:

Rural and Agricultural Finance

It’s our mandate to provide agricultural credit facilities to support all agricultural value chain activities, provide non-agricultural micro credit, Savings mobilization, Capacity development.

This we achieve through cooperative development of agricultural information system and provision of technical support and financial advisory services.

PRODUCTS & SERVICES

Supporting Nigeria's

Agricultural Value Chain

The Bank provides Agricultural Credits finance to support rural savings and Micro, Small and Medium Enterprises (MSME).

Our Vision:

To be the foremost Development Finance Institution in Agricultural Value Chain Financing in Africa.

DO MORE

Explore Our Services

Tailored to stimulate agriculture, improve lives and grow communities while delivering an exceptional customer services and support.

BE INFORMED

Whats New!

Stay abreast on our Latest News, Blogs, Press Release, Events, Project Developments, Tenders and Submissions